Recurring Payments

Scope

Recurring Payments functionality allows merchants to get an approval in advance from a customer for future payments.

Merchants can use this approval in advance to take payments from the customer on a regular or irregular schedule. An example of a regular schedule is a subscription, an irregular schedule is where the amounts and/or frequency of payments fluctuates.

The merchant must maintain the schedule of any recurring payments and use an API call to start each individual payment.

Use Cases Supported

The Recurring Payments functionally supports the following business use cases:

- **Fixed Subscriptions: ** Customers pay a consistent recurring price at regular intervals for access to a product. The subscription may include a trial period where the customer does not pay at the time of registration, but at some point in the future

- **Flexible Subscriptions: ** Customers pay a varying price at regular or irregular intervals for access to a product. The subscription may include a trial period where the customer does not pay at the time of registration, but at some point in the future

- **Stored Payment Method: ** Customers store Clearpay as a payment method with the merchant. Customers agree to use Clearpay to pay for future payments. The merchant can take payments without redirecting customers to Clearpay for explicit transaction approval. This is because customers have already given their approval in advance.

Approval for each use case above is dependent upon a number of factors. These factors include merchant location, merchant business vertical, and individual merchant risk factors. Contact your Clearpay representative for more detail.

To support the above, Clearpay has provided support for the following use cases:

- **Customer Stores Payment Method with Merchant: ** By following this flow, the merchant gets approval from the customer to take payments from the customer to the merchant. This is the first step in each of the business use cases above, when the merchant doesn’t need an upfront payment from the customer

- **Customer Stores Payment Method with Merchant with Upfront Payment: ** The merchant gets approval from the customer to take payments as well as take a payment at the time of approval. This is the first step in each of the business use cases above, when the merchant takes an upfront payment from the customer

- **Merchant Initiates Customer Payment Against Stored Payment Method: ** This flow uses the stored payment method from the previous use cases to start a new payment from the customer to the merchant

Customer Experience

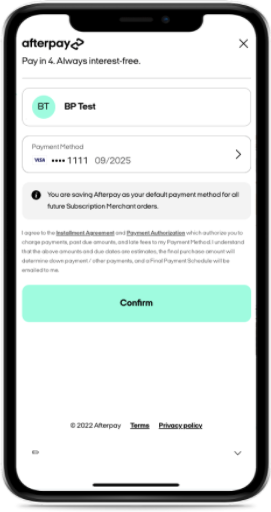

A customer stores their payment method with a merchant. The pictures below show Afterpay screens, Clearpay is identical.

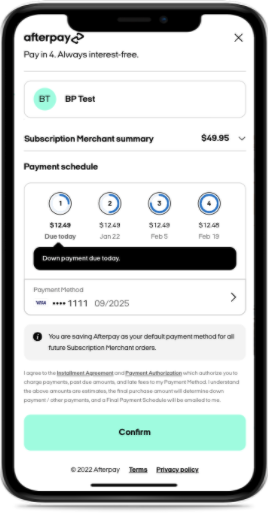

Below - A customer stores their payment method with a merchant with an upfront payment.

Recurring Payments - More Information

- Store Clearpay as a Payment Method

- Checkout and Store Clearpay as Payment Method

- Create a Recurring Payment

- Recurring Payments Flow

- Setup Billing Agreement Approval

- Create Billing Agreement

- Get Billing Agreement

- Cancel Billing Agreement

- Create Recurring Payment (Immediate Capture)

- Authorise Recurring Payment (Deferred Capture)